Ideas of things

Siamo Progettisti, ingegneri, esperti di reti di telecomunicazioni

Progettiamo e ingegnerizziamo le infrastrutture delle reti wireless e in fibra ottica attraverso i nostri Servizi e le nostre Consulenze per la Digital Transformation

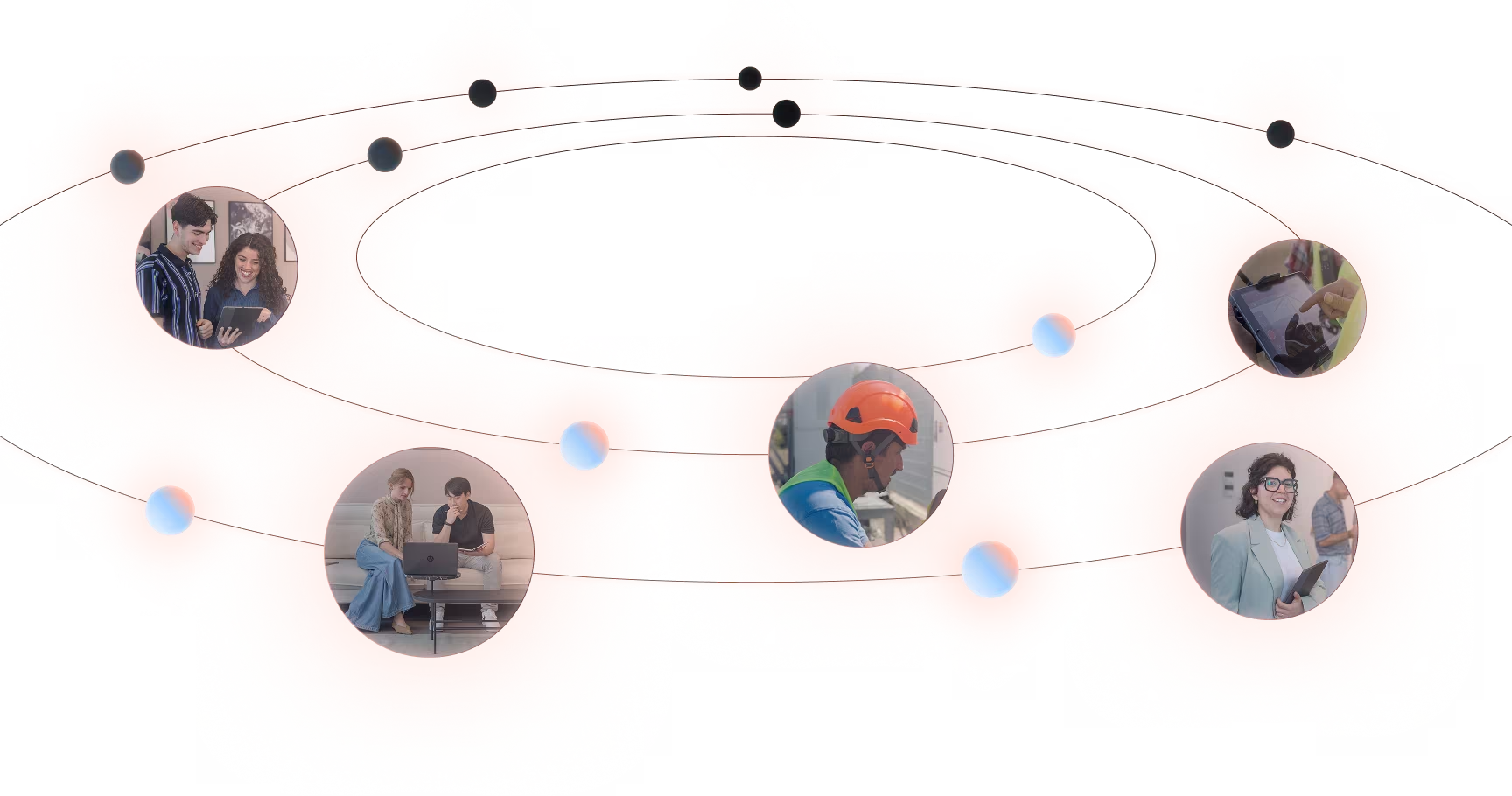

Probabilmente, in questo momento, mentre utilizzi un device digitale, stai usufruendo di un servizio o di un'infrastruttura a cui abbiamo dato il nostro contributo.

Le nostre radici sono la base del futuro che costruiamo assieme a voi giorno dopo giorno rimanendo fedeli ai nostri valori

Etica, trasparenza, inclusione, imparzialità, efficienza, imprenditorialità

In una parola...

Le tecnologie evolvono. Noi con loro. I nostri valori restano

per questo attraiamo i migliori talenti

per questo ti sosteniamo con un gruppo affiatato, poliedrico, comunicativo

il partner ideale per la tua crescita